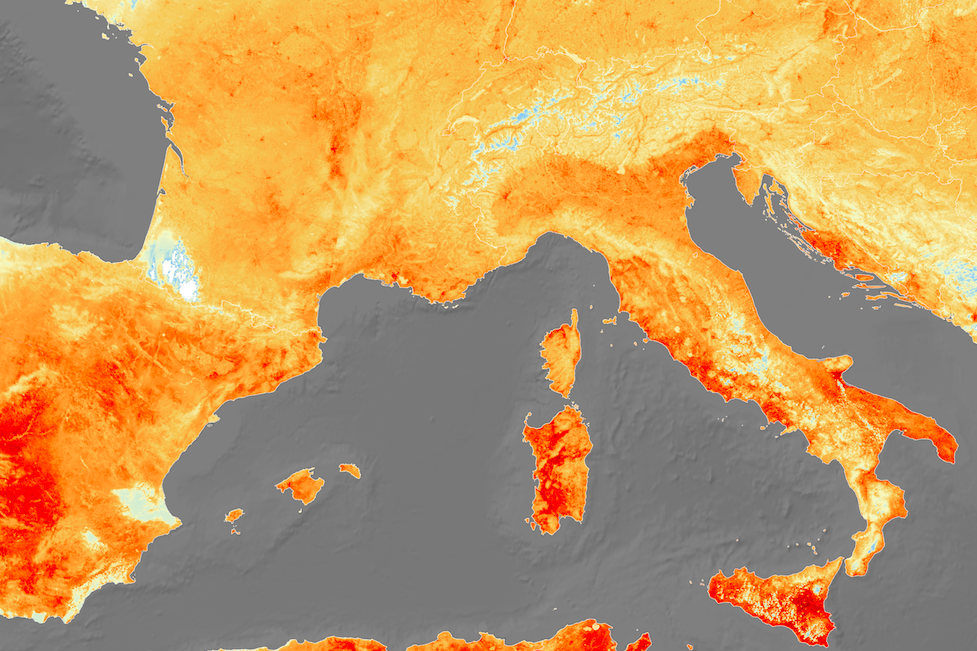

You may not have noticed by glancing at all those doctored-up photos of your friends boasting about their transatlantic travels on Instagram, but it’s been a brutal summer in Europe. This year's relentless European heat wave resulted in record-setting temperatures across much of the continent.

In addition to the human toll and amplified calls for taking action on climate change, the surge in temperatures has caused one market in particular to heat up: Europe’s carbon credit market.

Carbon credits date back to the 1997 Kyoto Protocols, when signatories of that agreement envisioned a market buzzing with activity led by energy companies, power plants and heavy manufacturing companies like automakers. Think of the system as a version of musical chairs: Regulators limit how many carbon-emitting permits can be issued at a time, and companies buy, sell and use them. A similar system green-lighted by U.S. President George H. W. Bush in the early 1990s helped curb “acid rain,” which was rampant due to sulfur emissions across much of the northeastern United States and Great Lakes region.

Europe’s carbon market kicked off in 2005, but soon sputtered. The global financial crisis was one huge factor, along with the fact that some industries were grandfathered and therefore exempt from the system. Other companies harnessed other climate-friendly tactics, such as investing in renewables.

But earlier this decade, emissions across the European Union began to spike, spooking policy makers. The EU started to reduce the total number of carbon credits. Add this summer’s scorching heat, and you have a perfect storm. According to the Wall Street Journal, the price of these credits has increased 400 percent during the past two years.

And despite the other European heat wave -- bubbling populist movements across much of the continent -- the Financial Times has noted that many EU leaders feel “bullish” about environmental policy. Hedge fund managers also are noticing the activity and are joining the fray, which further helps to boost prices.

Other segments of the carbon market are enjoying a spike of activity as well. According to Bloomberg, the “flight shame” movement led by activists such as Greta Thunberg has sparked a surge of carbon offset purchases as more Europeans seek to mitigate their environmental footprint while traveling by air. Even penny-pinching Ryanair passengers are on the bandwagon, with the airline reporting that the number of customers who have purchased offsets has doubled during the past 18 months. The ongoing backlash against flying even nudged the Dutch national carrier KLM to suggest that passengers book train tickets instead of braving the skies in some circumstances.

Not everyone is a fan of this trend.

“Small companies have been weeded out, highly regulated global carbon and renewable energy markets have been set up, and thousands of participating companies and charities are now theoretically held to international standards by independent verifiers,” Guardian environmental writer John Vidal recently wrote. “As the climate emergency grows, so too does the money involved – and the need for accountability.”

As for any carbon pricing plan, including emission credits, Scientific American’s Scott Tinker concluded that the only way such programs can succeed is if they scale up and become global. “If actions taken to reduce atmospheric emissions in one region result in increased emissions elsewhere, then the one atmosphere suffers,” Tinker wrote last week.

Image credit: European Space Agency

Leon Kaye has written for 3p since 2010 and become executive editor in 2018. His previous work includes writing for the Guardian as well as other online and print publications. In addition, he's worked in sales executive roles within technology and financial research companies, as well as for a public relations firm, for which he consulted with one of the globe’s leading sustainability initiatives. Currently living in Central California, he’s traveled to 70-plus countries and has lived and worked in South Korea, the United Arab Emirates and Uruguay.

Leon’s an alum of Fresno State, the University of Maryland, Baltimore County and the University of Southern California's Marshall Business School. He enjoys traveling abroad as well as exploring California’s Central Coast and the Sierra Nevadas.