(Image credit: Rawpixel.com/Adobe Stock)

We find ourselves amidst an intensifying climate crisis, aggravated by the sluggish impact of government legislation. At the same time, media sensationalism surrounding ‘woke’ corporate environmental, social, and governance (ESG) practices is making many businesses nervous about investing time and money into ESF programming.

This presents a pivotal moment for businesses. Embracing sustainability isn't just a moral imperative. It's a pragmatic necessity. Those businesses that continue to invest stand to reap a plethora of rewards, from improved employee engagement to enhanced consumer loyalty. And this isn't an either-or scenario that pits product against purpose; it's about harnessing ESG efforts to drive performance, creating a win-win situation where companies can make a positive impact while seizing lucrative commercial opportunities.

The Size Of Prize report, released this week by the research-tech firm Glow in partnership with TriplePundit and 3BL, underscores this point emphatically. It reveals a staggering $44 billion potential windfall awaiting brands that are perceived as more sustainable — and that’s just from 12 U.S. industries.

Capturing a share of the sustainability bounty demands more than mere lip service to eco-friendly practices. It requires a concerted effort to do better and to communicate those efforts effectively.

While consumers express a desire to support environmentally conscious brands, myriad obstacles often stand in their way. Price is consistently a barrier, but surprisingly, it isn't always the primary deterrent that limits people from shopping more sustainably. In fact, in 5 out of the 12 industries covered by the SOP report, factors like familiarity, availability, or a lack of education were found to exert significant influence on consumer decisions. For example, more than a quarter of consumers say they don’t choose more sustainable energy options because they aren’t available to them. Across industries, around a quarter of consumers said they "don’t know enough" about brands' sustainability credentials to make an informed decision, while nearly 20 percent said they don't see a "significant difference" between brands when it comes to sustainability.

For brands operating in sectors as diverse as automotive, financial services, food and grocery, retail, and pension funds, addressing these predominantly communication-driven barriers is the key to attracting more conscious consumers.

The food and grocery sector leads, but barriers remain

Let's dig into some industries to illustrate the point. A key industry seen to be leading the way in sustainability is food and grocery — which ranks in the top three most sustainable industries, according to consumers. However, this position of leadership does not mean all brands are doing brilliantly, or all consumers are purchasing sustainably.

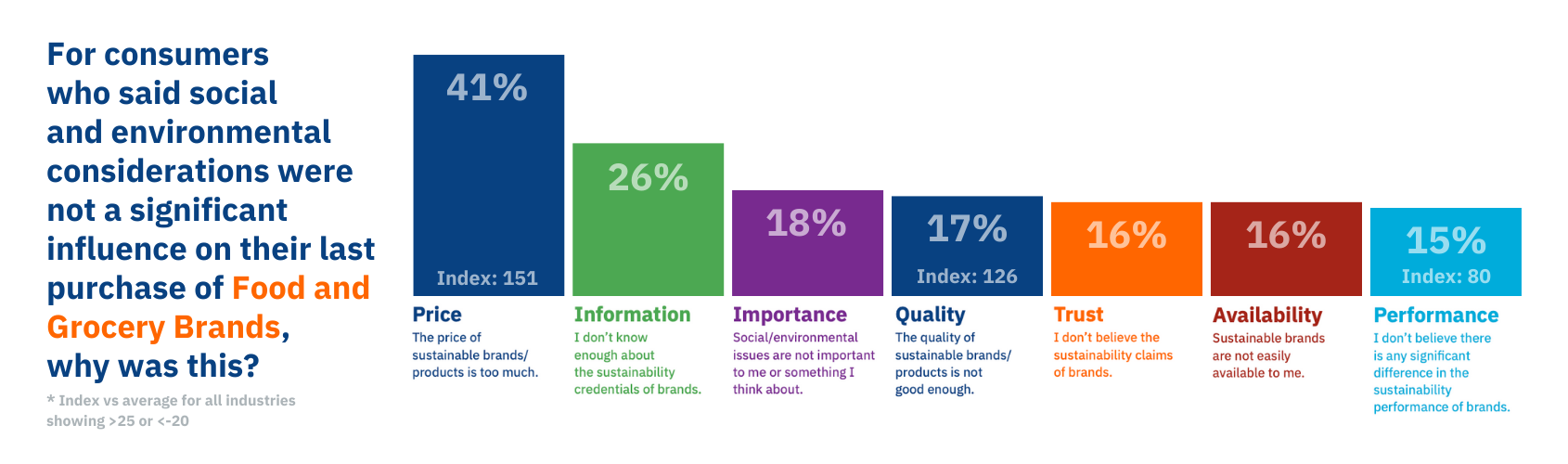

Four in 10 consumers say that sustainability considerations had a “significant” influence on their choice of products within their last grocery shop, according to the Size of Prize report. Price was the key barrier amongst those for whom sustainability wasn’t a serious consideration while grocery shopping. This is not surprising given the current cost of living crisis and the huge impact grocery bills have on overall household budgets.

Two other barriers to more sustainable choices stand out within this industry. Information is the second largest choice barrier — people say they don’t know enough about the sustainability credentials of brands to judge them. This is clearly a communication issue, highlighting the importance of promoting your positive actions if you want people to choose you over other brands.

Quality concerns are the other interesting area that is disproportionately higher in this sector than in others (bar automotive and fashion). People worry whether sustainable products will functionally deliver to the level they expect. For example, will plant-based meats taste as good, or eco-friendly cleaning products clean as effectively? Quality concerns can be mitigated by experience, requiring brands to stimulate trial and demonstrate social proof, tasks underpinned by strong communication.

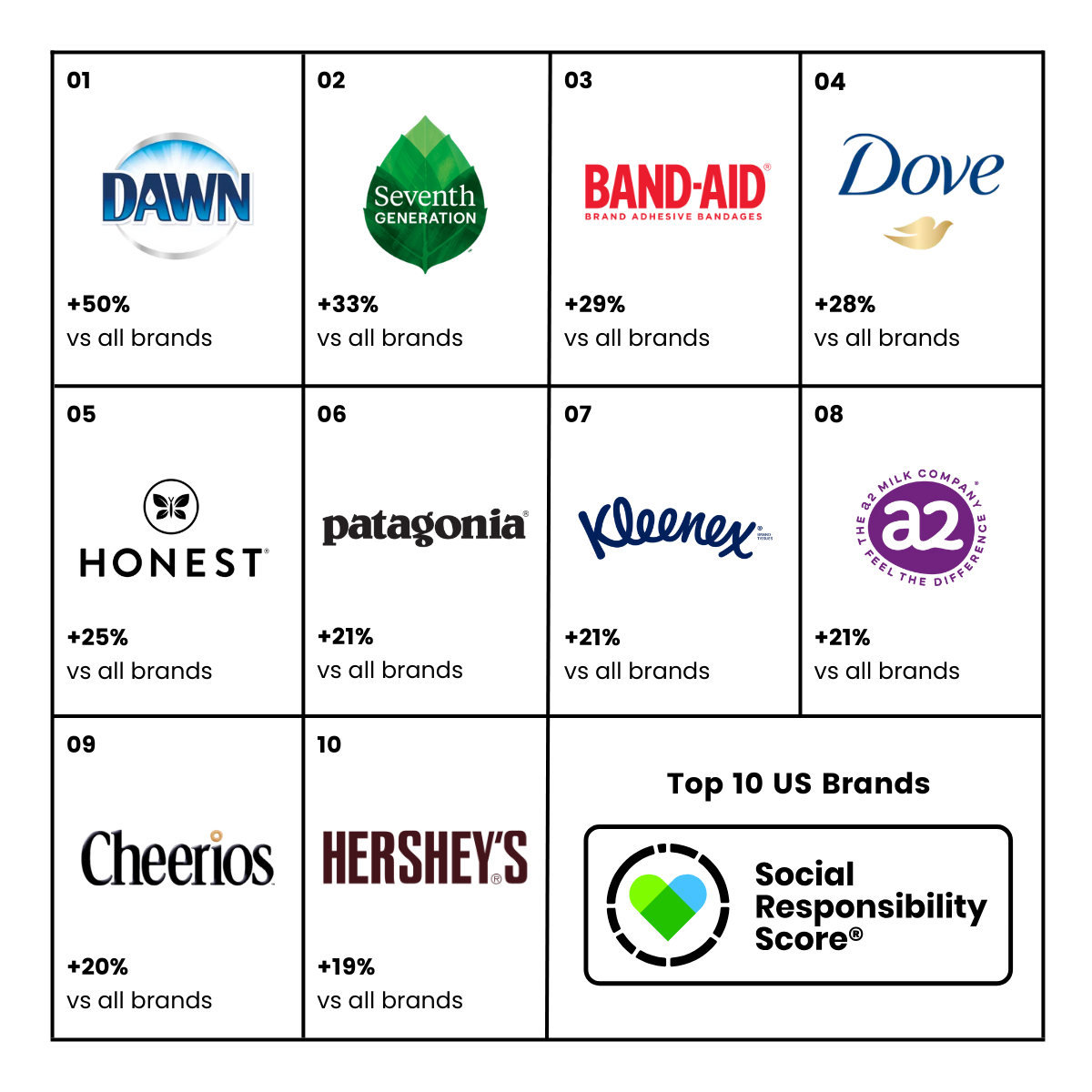

An example of a good product marketed effectively is Dove — a brand consistently ranked by consumers as a top 10 sustainability leader, as measured by Glow’s Social Responsibility Score (SRS). Dove is not the cheapest brand available, nor is it priced significantly above the category average. Dove offers a great product at a good price while also having a differentiated social positioning by championing body positivity, mental well-being, and inclusion, which has helped the brand succeed in highly competitive categories.

Banks need to educate consumers

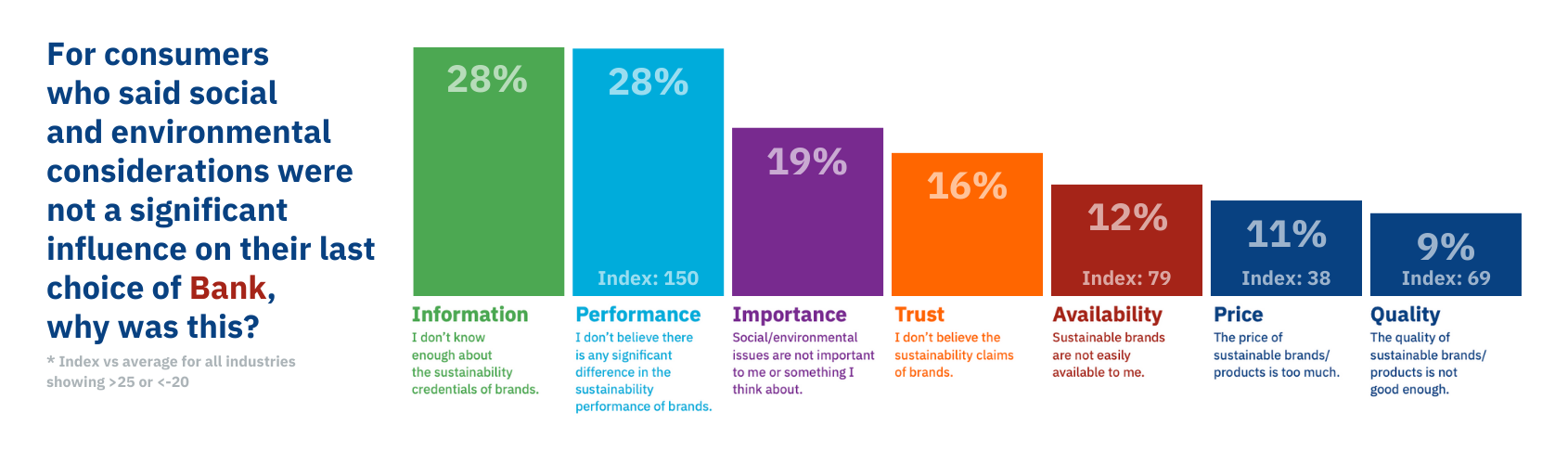

In contrast, banks are generally not well respected in terms of their sustainability credentials. This is backed up by SRS data which shows the large U.S. banks tracked scoring 20 percent or more below the average score for all brands, with little differentiation in score between the major banks (bar one performing significantly worse). Given all banks are spending many millions in ESG areas, this highlights their failure to effectively communicate their efforts.

Nearly 8 in 10 consumers say it is important for banks to act responsibly when it comes to society and the environment, but only 1 in 3 say their last choice of bank was significantly influenced by sustainability considerations. Why the gap? The key barriers are educational: a lack of information about banks’ sustainability credentials and a view that all banks are the same.

This represents a massive opportunity for banks with good ESG credentials to activate consumers by telling their story with conviction. There is evidence of this success in other markets where SRS data shows banks with a strong community or purpose focus score better than average perception scores.

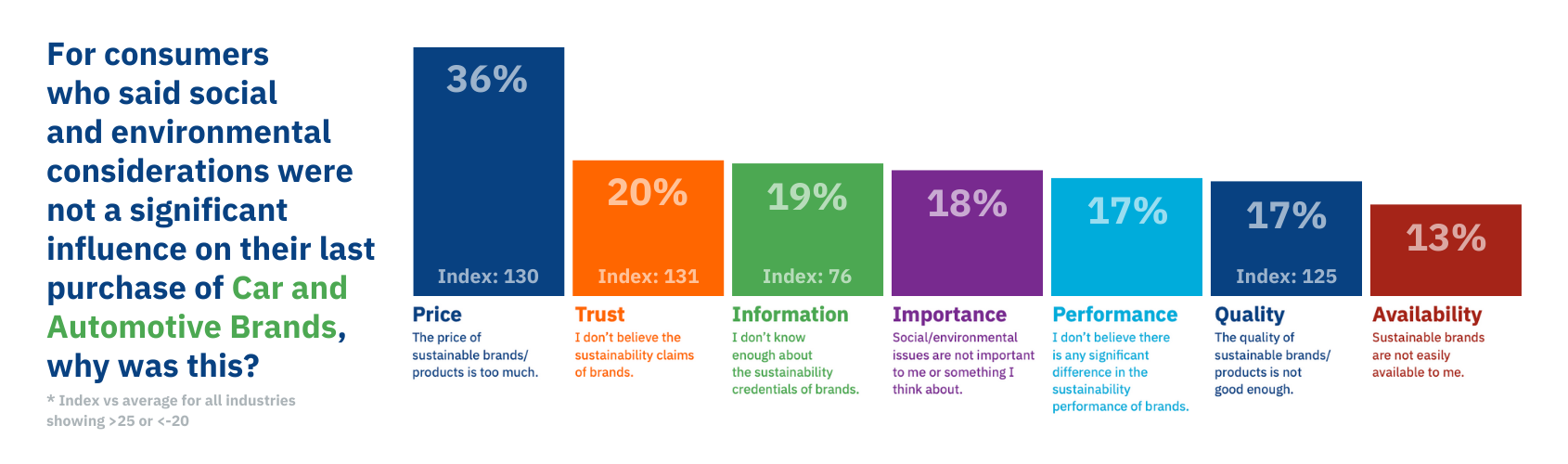

Trust is important for auto brands

For the car and automotive industry, price is the top barrier getting in the way of more sustainable choices of vehicle, but trust is the second most important barrier and disproportionately important for this industry. This reflects the impact of multiple safety, environmental, and managerial controversies in recent years which have eroded consumer trust in what auto brands say about their ESG impact.

Transparency is key to building trust, and the brands that are doing this well, such as Toyota, are starting to establish a differentiated position in the eyes of consumers.

The barriers are coming down

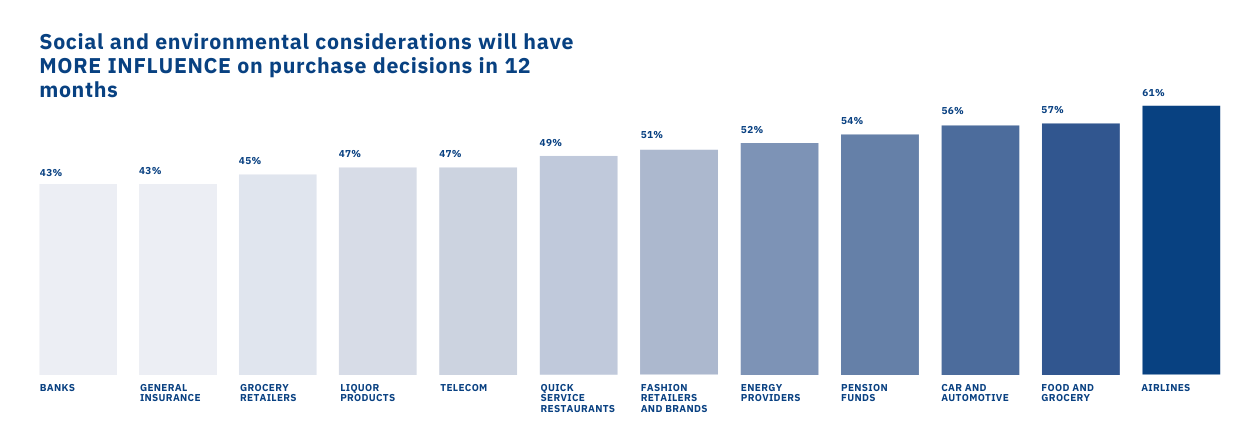

What is clear across all industries is that the impact of sustainability on purchase behavior is and will continue to increase. Over half of consumers said sustainability concerns were more important in their purchase decisions than a year ago (with only 15 percent saying they were less important), while similar numbers anticipate these considerations being even more influential on decisions a year from now.

It's time to take action. As we navigate the challenges and opportunities of sustainability in business, it's crucial for each of us to evaluate our own programs. Are we truly maximizing our potential to drive positive change? Are we effectively communicating our efforts to consumers?

I urge you to take a moment to assess your company's sustainability initiatives and how you are communicating them. Identify areas where you can break down barriers and enhance consumer engagement. Whether it's improving product availability, educating your audience, or refining your messaging, there are steps you can take to position your brand as a leader in sustainability.

By evaluating and enhancing your sustainability programs, you not only contribute to a better future for our planet but also unlock significant commercial opportunities for your business. Let's seize this moment to make a meaningful impact.

Access the Size of Prize report here

Access sample brand sustainability reports here

(This article series is sponsored by Glow and produced by the TriplePundit editorial team.)

Mike Johnston is Managing Director of Data Products at Glow.