(Image: Andrea Izzotti/Adobe Stock)

"Climate risk is investment risk," BlackRock CEO Larry Fink wrote in his 2020 letter to executives. The definitive statement from the head of the world's largest asset manager widely signaled the mainstream adoption of climate risk as a metric in investment decision-making. Tanay Tatum-Edwards, CEO and founder of the data provider FreeCap Financial, wants to do the same with prison risk.

The movement to mainstream prison risk as a financial metric moved one step further with a newly launched "decarceration index" that's proven to deliver above-market financial returns.

What is prison risk anyway, and why should investors care?

In a March edition of Brands Taking Stands, we took a deep dive into FreeCap Financial's 2023 Criminal Justice Report, which ranks the largest U.S. companies based on their vending contracts with prisons, use of prison labor and fair chance hiring policies for people with criminal justice histories.

Though most don't realize it, profiting from the U.S. prison system goes far beyond private prison operators. Companies across every industry in the Russell 3,000 Index made more than $8.6 billion from state and federal prison contracts between 2019 and 2022, according to FreeCap Financial. Less than a fifth of the S&P 100 Index, which includes the largest U.S. companies, ban the use of prison labor.

Being publicly linked to prison labor and prison profiteering has proven to be toxic to companies' reputations, with some being linked to prison labor in the media decades after banning it.

Further, as the United States faces labor shortages across industries, refusing to hire the estimated 1 in 3 American adults with justice involvement that would appear on a background check could easily leave companies short-staffed and falling behind in the race for talent.

All of this adds up to material financial risk for companies and their investors. "There's these trends showing that companies who engage in fair chance hiring are going to remain competitive, and folks who are profiting off of prison are engaging in reputational risk," Tatum-Edwards said. "If you are looking at those trends, companies whose business models are fixed around and rely upon profiting off of prisons are going to have trouble as incarceration decreases."

FreeCap Financial's Prison Vending Relationship Dataset and S&P 500 rankings for prison labor and fair chance hiring give asset managers the tools to reduce their exposure to prison risk and drive more values-based investment.

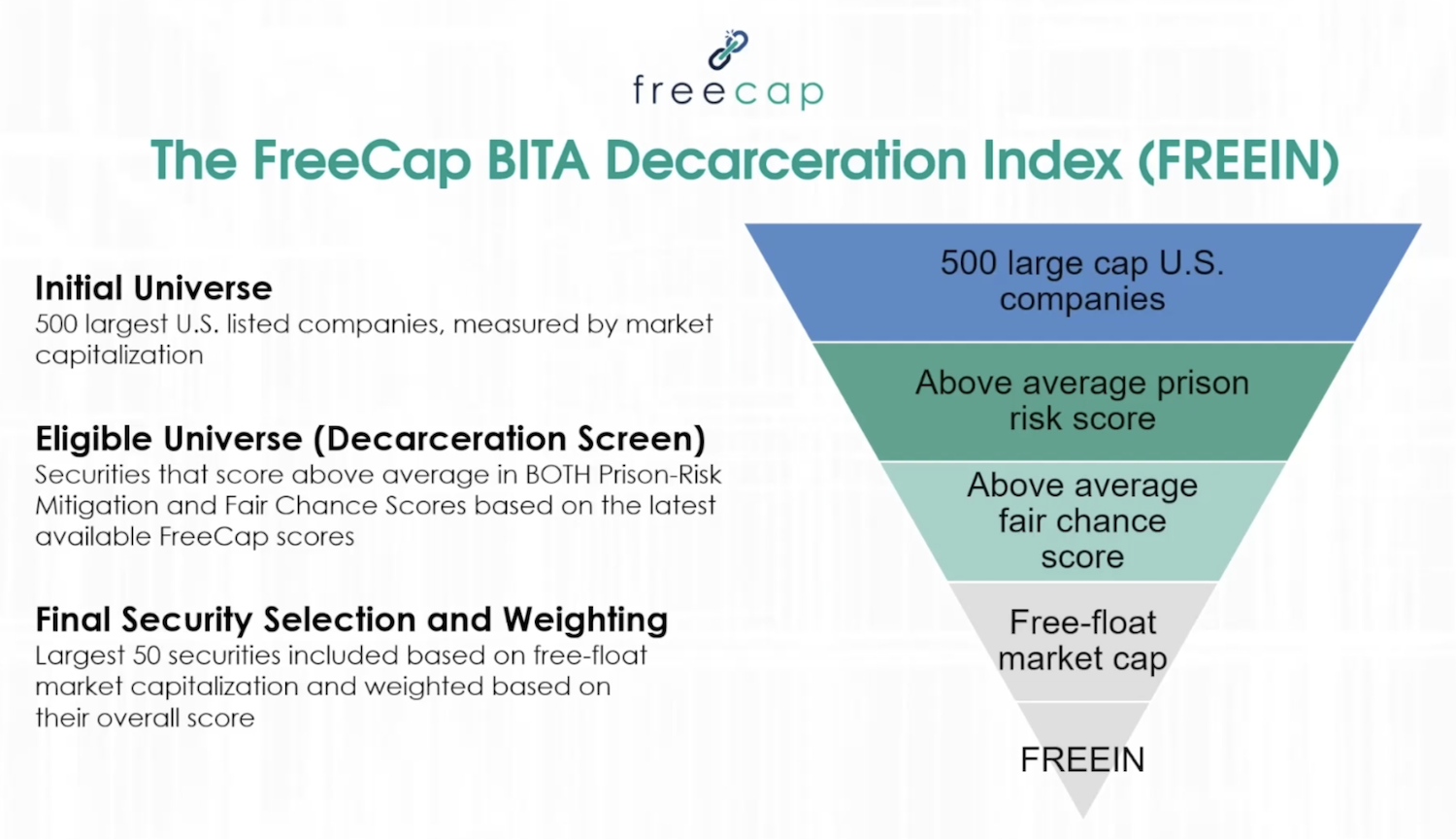

The newly launched FreeCap Financial BITA Decarceration Index, developed with the investment index technology firm BITA, translates this research into an investable product — and the results are promising.

The Decarceration Index helps investors reduce prison risk while delivering strong returns

Tatum-Edwards sees the movement to mainstream prison risk and fair chance hiring as financial metrics being similar to the early days of gender-lens investing when researchers began building indexes that screened out companies with all-male boards of directors.

"All these companies went from all males to having three women on the board of directors so they weren't negatively screened," she explained. "It was very quick to happen because it became something that was explicitly excluding capital. Now every big bank has their version of a gender index."

The new decarceration index, also called the FREE Index, includes companies in the S&P 500 that deliver top performance on both prison risk mitigation and fair chance hiring.

"Measuring prison labor and vending contracts can't be successful in isolation without fair chance hiring," Tatum-Edwards said. "But we didn't want companies who engage in hiring but profit from prisons to make the list. You have to be actively involved in decarceration at both ends."

The Index includes 50 of the largest U.S. companies, including Apple, Google parent company Alphabet, chip maker Nvidia and financial giant JPMorgan Chase.

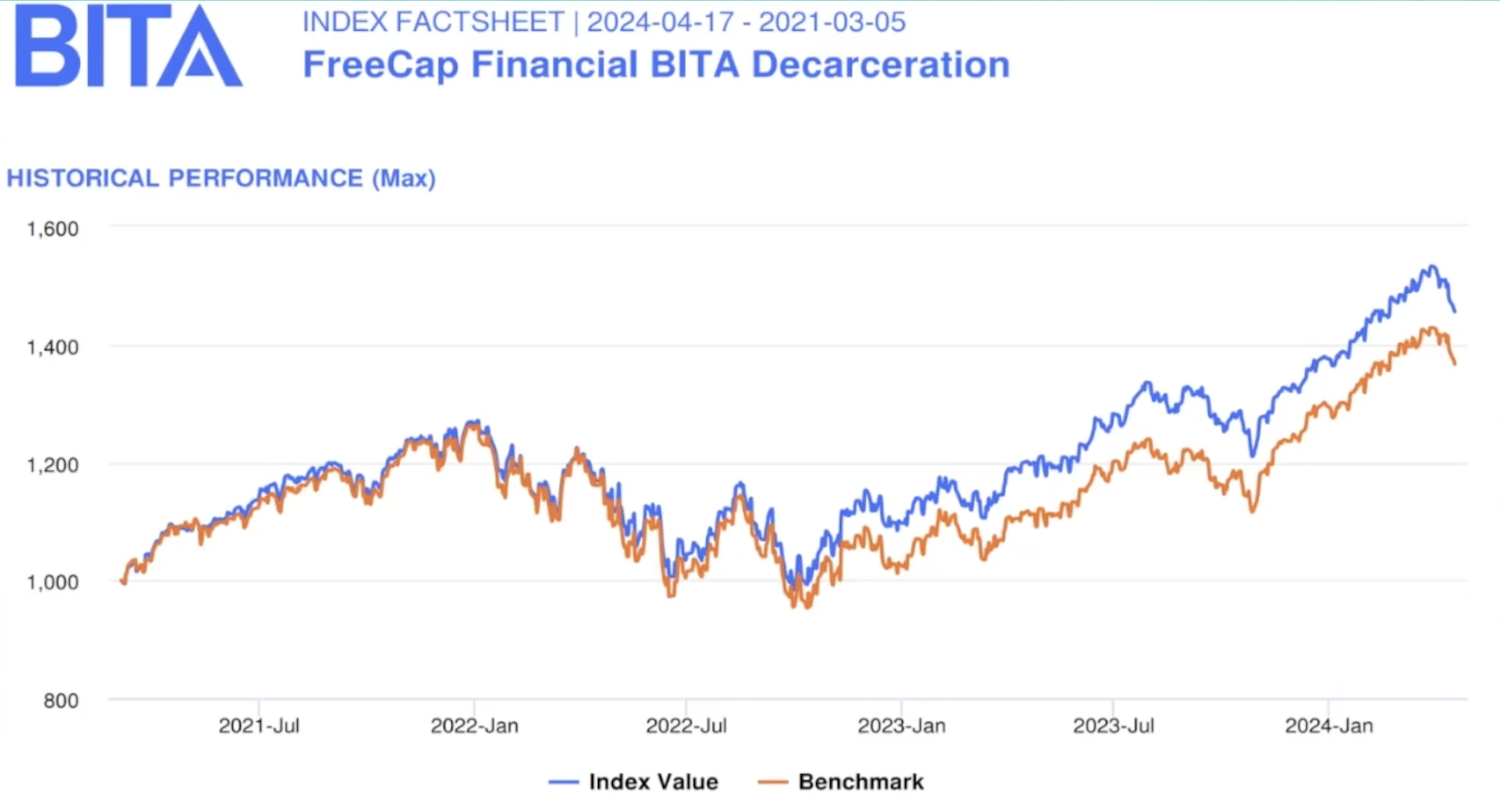

"From an economic perspective, we believe that companies who are using fair chance hiring as a way to address labor shortages in their supply chain are going to have the biggest financial benefit from it," Tatum-Edwards said. "What excites me about the research is that our initial backtesting shows it is profitable. Isolating that variable out is actually profitable. I didn't know that was going to be the case going into it. But now that we do, it makes it a real opportunity to be ambitious with our product development … because it’s good for business."

Based on backtesting, which tracks the portfolio companies' historical performance, the Index has potential to deliver above-market returns. "We only have three years of backtesting, but for the last two years, our investment thesis beats the iShares S&P 500 index," Tatum-Edwards said.

Asset mangers can license the Index to create their own financial products or use it as a screen in their portfolios. "This index is basically a ready-made list of equities that a fund manager can replicate to create their own product," Tatum-Edwards said. "It succinctly communicates the value proposition and why it's important."

By turning ranks and scorecards into an investable product, FreeCap is able to demonstrate that screening out companies exposed to prison risk, while screening in companies leading the pack on fair chance hiring, can actually be profitable.

In doing so, the Index provides a key signal to investors that these factors influence their returns. "Then what you're able to do is make prison risk a material financial metric, which gets incorporated into the way everything is measured," Tatum-Edwards explained. "Even if you're not completely screening, it impacts how a company is valued and how capital is allocated."

While the Index is limited to asset managers and researchers at present, FreeCap Financial is working to turn it into a retail investment fund — which would make it available to everyday investors and allow companies to include it as an option in their 401(k) plans.

It's likely to receive a warm reception, as 80 percent of retail investors think it's important to consider how their portfolios impact economic inequality, according to recent research from GlobeScan and InfluenceMap.

"Customers drive demand for products," Tatum-Edwards said. "That is one of the main reasons why our team is so committed to creating a retail product, because [nearly 1 in 2 Americans] have a family member who's impacted by incarceration. It's a uniquely American problem, and I think we all want to figure out how to leverage the resources we have at our disposal to impact it."

The retail version of the FREE Index is expected in early 2025, and TriplePundit will have all of the details. Subscribe to our weekly Brands Taking Stands newsletter to stay up-to-date.

Mary has reported on sustainability and social impact for over a decade and now serves as executive editor of TriplePundit. She is also the general manager of TriplePundit's Brand Studio, which has worked with dozens of organizations on sustainability storytelling, and VP of content for TriplePundit's parent company 3BL.