Part of the problem or part of the solution?

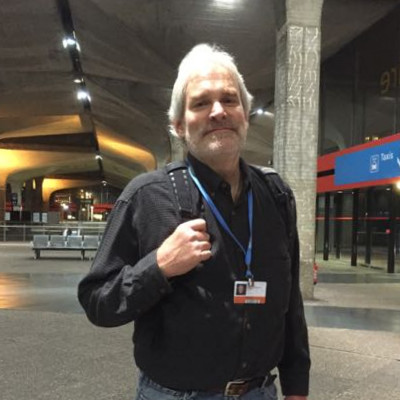

"I think a lot of people blame the 'top 1 percent' for causing 'big evil corporations' to act in socially and environmentally unethical ways,” says Nathan MacKenzie Brown, a 34-year-old entrepreneur and impact investor -- and one not prone to mince his words.

Brown doesn't deny the consequences stemming from the concentration of wealth in the U.S. But the fact is that the spread of stock ownership has changed dramatically in the past 30 or 40 years. More Americans than ever before, 47 percent, own at least some stock.

"It certainly isn't fair to blame the horrible behavior of corporations on the top 1 percent alone,” Brown says. "I think it is time for every one of us who puts money into an investment account for retirement to realize we are either part of the solution, or we are part of the problem."

The task then, for those of us wishing to be part of the solution, is to reconcile our economic interests with our social values.

The invisible heart of the markets

TriplePundit readers are likely familiar with impact investing, a concept that embodies the triple bottom line philosophy driving this blog. In a recent 3p post, Andrew Burger gives an excellent account of its growing momentum, what the G8 Social Impact Taskforce calls “the invisible heart of the markets.”

According to a recent study by the Global Impact Investing Network (GIIN), $45 trillion is committed to socially responsible investment funds (SRIs) and similar investments that integrate "environmental, social and governance factors into their investment decision.” Impact investing takes the passive screening framework of SRIs one step further. If just a tiny fraction of those trillions were devoted to impact investments, it could ignite a “revolution," transforming the capital markets into an incentivizing force for positive, measurable change in the world -- “moving the needle” on the most challenging social, environmental and governance issues we all face.

Talk of revolutions for positive social change sounds exciting, but most of us don't have a lot of time or money; we just want to make the most of what we do have. How should a socially conscious investor who just wants to do right by their investment dollar make the right choices? For Brown, this question drives at the core of what ails business-as-usual capitalism.

"I certainly think that less sophisticated investors are likely to run into confusion when trying to align their economic and social values,” says Brown. "I think this is actually the heart of why our current economic system is so socially unjust and unsustainable, because most individual investors simply don't have the time, energy or understanding to prioritize making socially and environmentally responsible investment choices.”

While there is no 'easy button' for making investment decisions or solving complex social and environmental challenges, there are real opportunities for an impact investor to make a difference (and a buck), and many of them are found on Main Street, not Wall Street. But it takes patience and and a willingness to be more flexible about expectations of risk and reward. Impact investing brings philanthropy to an entrepreneurial mindset. Don't let that scare you away.

"I think impact investing is in the early days,” Brown says, "and it will become much bigger as a result of the boomers passing about $41trillion in assets to millennials who are less likely to invest in the stock market and are more likely to think that financial and social interests should overlap. I think this is a powerful combination that will have a heavy and positive influence on the future of investing in America and the world.”

Your own path to impact

Brown, a successful Internet marketing consultant, counts himself among the ranks of millennials looking to make a difference in the world. But he isn't a 'typical' millennial, business owner or socially conscious investor. I'm sure there’s no such thing in any case.

You aren't likely to bump into Nathan at the airport on his way to Vegas for the latest industry 'summit' or see him at the local Starbucks sipping a grande Mocha Machismo (or whatever they're calling a cup of coffee these days) -- and that’s the point.

Impact and social investing should reflect a person’s core beliefs, their lifestyle, what is important to them and how they view the world. Binding the common thread of helping build a better world is the myriad of ways to go about doing it. Nathan’s story is unique, as we shall soon see, but through his example we can imagine how any investor can forge their own “path to impact."

Lessons learned and a head start

Brown admits in a recent Forbes article that he is “one of the lucky ones." With a free ride through college on behalf of his professor father and a $55,000 inheritance from his great-aunt, Brown knows he got the kind of head start that most others don’t.

Instead of engendering a sense of entitlement, his “unearned privilege,” combined with a pivotal experience of social injustice in his teens, became the genesis for Brown’s philosophy and worldview. He understood his good fortune as an opportunity to give back. Brown put an inflation-adjusted price on his free education and inheritance -- $306,000 -- and made it his life target for doing just that.

The good life: Simplicity in the 21st century

Sometimes called the 'guru's guru' of Internet business consulting, Brown could have easily followed the path of an upscale young urban professional in the digital age, with all the trappings of success that entails. He sought a different path, choosing instead to use his skill and knowledge to live a modern life of deliberate simplicity.

“Live simply so that others may simply live,” says Brown. “But I would take it a step further and say, 'Live simply and help others so that others may simply live.' I like all my impact investing to either help people to live more simply, or to help others to simply live."

For Brown, living simply led him to the Dancing Rabbit Ecovillage, where he eventually became a resident in 2005. Started in 1997, Dancing Rabbit is an experimental community in Rutledge, Missouri devoted to cooperative and sustainable living.

His lifestyle allows him to live on less than $20,000 per year, and his online consulting business provides an annual income of between $40,000 and $60,000 (some years are better than others). Brown's goal is use most of those net profits to help others “simply live, or live simply." Brown’s typical workweek is rarely more than 12 or 13 hours, spending most of his time as a member of the Dancing Rabbit community. This community and what it represents is the foundation for much of his impact investing.

Think globally, act locally, invest in both

Brown’s advice for those getting started in impact investing is to go with what you know. Look for opportunities in your own area of expertise, your local community and your network of friends and colleagues.

Dancing Rabbit's mission of simplicity, sustainability and intentional living inspires much of Brown’s impact investment strategy and is also the source of some of his most successful impact investments, for example:

- A $9,750 loan to buy a fourth car for the Dancing Rabbit Vehicle Cooperative (DRVC) expanded the service for its 60 members, bringing a 5 percent return. Brown considers this his “most successful impact investment because of the strong ecological return of this investment, while still having financial return that beats inflation.”

- A $5,000 loan at 4 percent interest helped a friend buy a house.

Making loans can be one of the simplest ways to start an impact investment program. The opportunities aren't limited to your immediate community or circle of friends, making impact through investment must look to the global community as well. "If I only focus on investing in my local community, then I don't really provide any direct assistance to the people in the world who most need help."

"The fact that I've focused so much of my impact investing in my local community is more of a reflection on the importance I place on living simply than it is a reflection on the importance of investing locally. Because I live at Dancing Rabbit Ecovillage, when I invest in my community I help forward a model of a very simple and rewarding lifestyle that can help inspire others to live simply as well."As more people choose a simpler life, that helps to address the environmental problems in the world. So, I think it is important to invest in ways that help people to live more simply, which helps address the environmental problems in the world, and to also invest in ways to help the poor of the world who are hit hardest by the worlds current environmental problems."

There are loan funds such as the Northcounty Cooperative Development Fund or the Cooperative Fund of New England that invest in worker-owned co-ops and nonprofits. Land trusts that conserve land or protect communities from gentrification provide even more avenues for impact investors. Brown also suggests approaching a favorite nonprofit directly. “Sometimes nonprofits need financing, too,” he says in Forbes. "They don't always just look for donations.”

Participating in SRI funds, though not impact investing per se, is a good way to diversify a portfolio for both economic and social return. Brown invests in the Calvert Community Investment Note, the New Alternatives Fund and Portfolio 21, a high-performing fund using the Natural Step model to address ecological issues.

Brown also recently spoke with the CEO of CuttingEdgeX, an online platform connecting social enterprise with investors.

Opportunities at Dancing Rabbit

Impact investment has helped Dancing Rabbit thrive. Tony Sima, one of the founders of Dancing Rabbit, raised $150,000 through loans to start the Better Energy for Dancing Rabbit (BEDR) power co-op.

Several other investment and business opportunities are currently available, including houses (to either live in or rent out) and the Milkweed Mercantile Eco-Inn. Individual entrepreneurs at Dancing Rabbit are often looking for help getting their businesses started. "I think some great opportunities could be identified and developed over time.”

More information about the houses for sale and the Milkweed Eco-Inn is available here.

Invest in knowledge, learn from experience

I think one key bit of advice Brown told me, especially for younger people just getting started, is to invest in your own awareness, skills and expertise.

For a young entrepreneurial investor, or anyone seeking to have a positive influence in the world, "The most important investment you can make in a better world is investing in your own knowledge,” says Brown.

The more curious and aware you are of the world around you, the more disciplined your thinking and the better chance you'll have of making an impact. The challenges we face won't be solved by self-absorbed skimmers Twittering away their lives. Learn something -- don't just get through college -- and apply what you learn in the real world. Most importantly: Learn from your mistakes, because you'll make plenty of them; everybody does. That’s where the real education begins.

"The more skill and experience you gain in your youth, the more you can leverage your learning for future benefits. You should be aware that much of what you will learn at first will will come from mistakes that you make, which may feel very discouraging at first.”

A failed investment in a climate change website cost Brown $8,000, but what he learned in the process landed a consulting contract with Treehugger.com, helped a friend start a successful online parent-coaching business and landed another consulting gig worth $9,000. "So, even though the initial investment I made was a total loss, the knowledge and experience I gained from it [proved] to be well worth it in the long run.”

"Keeping this sort of long term perspective in mind is very important. If you get discouraged and stop trying after a few failures, then you won't get to leverage your learning for future success and positive impact."

Imagine

I can tell you that living in an ecovillage likely isn't my cup of tea (though I fancy myself a 'treehugger'). That’s probably true for most. But for Nathan Brown, it represents his core values and expression of who he is and how he intends to help build a better world. From there he has found a path to invest his time, talent and money toward that end. What I admire most about Brown is the intentionality of his process. He saw the world as it is and decided to become part of the solution instead of part of the problem. Nathan is all in.

You don't have to live in an ecovillage to make a difference (though you can invest in one). Nick Aster started TriplePundit as a school project and in a few years time grew it into the leading publication on sustainable business. Through the website, countess changemakers, visionaries and “entrepreneurial philanthropists” have had their story told -- inspiring more to do the same, but in their own way.

What about you? How do you want to change the world, make an impact? It’s easy to be cynical these days and say it’s impossible for one person to make a difference. But we all know that’s not really true. You don't need to be rich or well-connected.

You have to imagine another world -- a better world. Then go about making it happen.

"I learned this, at least, by my experiment; that if one advances confidently in the direction of his dreams, and endeavors to live the life which he has imagined, he will meet with a success unexpected in common hours.”

- Henry David Thoreau

Brown’s tips

Nathan Brown’s tips for reducing your environmental impact:- Never fly. It is one of the worst possible things an individual can do to the environment. (ouch)

- Eat low on the food chain.

- Avoid traveling in a car alone as much as possible. Carpool, bike, walk and take public transit.

- Make your home as energy efficient as possible (one of the best ways to do this is to have roommates since this drastically reduces the amount of energy you need to use to heat and cool your home on a per person basis).

- Encourage other people to make these changes as well.

- Move all of your cash into a socially responsible bank. I use and recommend Beneficial State Bank because I think they are one of the best banks out there in terms of their social and environmental priorities.

- Invest in mutual funds, and make sure you pick socially responsible mutual funds. This site is a great resource for deciding which socially responsible mutual fund(s) you want to invest in.

- If you have enough money that you can afford to buy stock individually I recommend getting a socially responsible investment advisor who can help you make good financial investment that better match your values. A friend of mine uses and really likes this company.

Image credits: Nathan Brown; Brian (Ziggy) Liloia, courtesy flick

Tom is the founder, editor, and publisher of GlobalWarmingisReal.com and the TDS Environmental Media Network. He has been a contributor for Triple Pundit since 2007. Tom has also written for Slate, Earth911, the Pepsico Foundation, Cleantechnia, Planetsave, and many other sustainability-focused publications. He is a member of the Society of Environmental Journalists