By Stuart Doole, MSCI — Institutional investors increasingly are moving toward integrating ESG criteria into their portfolios and their factor allocations, in particular. This shift is driven by their recognition of the financial relevance of ESG issues to their risk management and their focus on long-term sustainable investing. But they face key challenges in doing so, such as: How can they enhance their strategies’ ESG profiles while achieving the desired exposure to their target factors?

Our research shows that this balance could be achieved by simultaneously incorporating ESG integration alongside factor exposure targeting in the index construction. The MSCI Factor ESG Target Indexes’ “one-step” optimization approach achieved significant improvement of the ESG profile of a single- or multi-factor index relative to its market-cap-weighted parent with modest or no negative impact on the indexes’ ability to capture factor return premia over the December 2007 to June 2017 study period. This approach was scalable across regions and countries, and across both single- and multiple-factor indexes.

We also found that the MSCI Factor ESG Target Index methodology — which includes a 20% improvement in ESG profile compared with the parent index — had better risk-adjusted performance than one with no ESG constraint in our backtest. Incorporating ESG generally tilted the index constituents toward stocks with higher market capitalization, better earnings quality, improved earnings stability, lower financial leverage and lower residual volatility. The improvement in historical risk-adjusted performance may be attributed to these factor tilts and the improved ESG profile as well as to stock-specific sources of return.

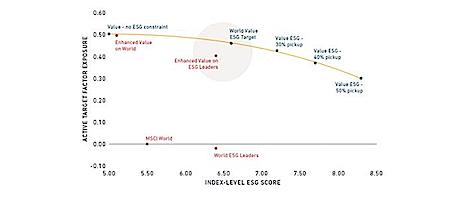

In the illustration above, we examine this trade-off between ESG improvement and maintaining target factor exposure for the MSCI World Value ESG Target Index over the study period. We compare the one-step approach (World Value ESG Target) with a two-step approach, where we built the MSCI Enhanced Value Index on top of the MSCI World ESG Leaders Index (Enhanced Value on World). Embedding ESG scores into the factor index construction provided a clear improvement in terms of target factor exposure and ESG index-level score. There were also benefits in relation to diversification. The MSCI World Value ESG Target Index averaged 377 constituents, while the two-step index had only 274. Hence, we obtained a better diversified factor index with a lower stock-specific contribution to its returns.

Taken together, the results shed new light on how institutional investors may choose to approach incorporation of ESG criteria into their factor allocations. Using the example of the MSCI Factor ESG Target Indexes, we see that, while not indicative of future results, ESG integration generally improved the information ratio (a measure of a portfolio manager’s ability to generate excess returns) of many typical factor-based indexes during our study period. This improvement in ESG characteristics—which was observed across a broad range of granular ESG metrics — came at little or no cost to target factor exposures.

Stuart Doole is Global Head of Index New Product Development, MSCI

TriplePundit has published articles from over 1000 contributors. If you'd like to be a guest author, please get in touch!