By Vikas Vij — Green bonds are debt instruments designed to finance environment-friendly projects. With most of the world now more strongly aligned on tackling climate change, governments and institutions are increasingly recognizing the potential of the green bond market as a significant transformational force to achieve carbon-reduction goals.

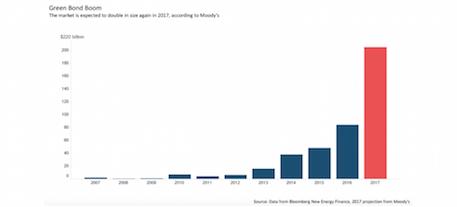

According to Bloomberg New Energy Finance, the global issuance of green bonds reached $95 billion in 2016. This was more than double the amount issued in 2015. A further $19 billion has been issued in the first two months of 2017. A recent Bank of America Merrill Lynch report revealed that sovereign issuances have been the biggest drivers of recent market growth, accounting for 48 percent of the current outstanding 2017 total.

In December, Poland became the first country to issue a sovereign green bond. This was swiftly followed one month later by the French government, which provided the largest issuance on record at $7.6 billion. Argentina also issued its first green bond in February, while Nigeria’s green bond is due to be launched soon, followed by Kenya, Morocco, Bangladesh and Sweden.

In terms of total issuances, China currently dominates the space, accounting for 36 percent of the global total in 2016. The US, meanwhile, registered $15 billion of green bond investment last year, which was 55 percent higher than the previous year.

Investors are also now beginning to see the potential benefits green bonds can offer from a risk management perspective.

BlackRock unveiled its Green Bond Index fund in late March. According to the firm’s head of climate solutions, Ashley Schulten, the fund was conceived after BlackRock noted firmer interest in green bonds from their clients.

Moody’s sees the green bond market surging to $206 billion in total issuance in 2017. Bank of America Merrill Lynch expects China to be the main driver, accounting for 30 to 50 percent of the expansion. The country’s strong desire to boost clean energy use and cut down on fossil fuels seems likely to push the green bond market in the coming years.

Source: International Banker

TriplePundit has published articles from over 1000 contributors. If you'd like to be a guest author, please get in touch!