ESG, which refers to how environmental, social and governance factors pertain to business, has been all over the headlines lately — and the debate has become increasingly contentious. Billionaires like Elon Musk call it a “scam,” consumers and business leaders see it as a strategic priority to develop more sustainable business models, while governments are implementing ESG standards as a way to act in the public’s interest.

Each of these diverse sets of stakeholders have a valid claim to ESG, but they also have radically different priorities when it comes to how it’s used. It’s no wonder, then, that debates around the topic between these groups often devolve into arguments, name-calling, and more shouting than listening.

In order to move the debate from combative to constructive, we need a shared language. Stakeholders need to be able to express what they want out of the movement, and be able to understand what others want out of it (even if they are approaching it from a different angle).

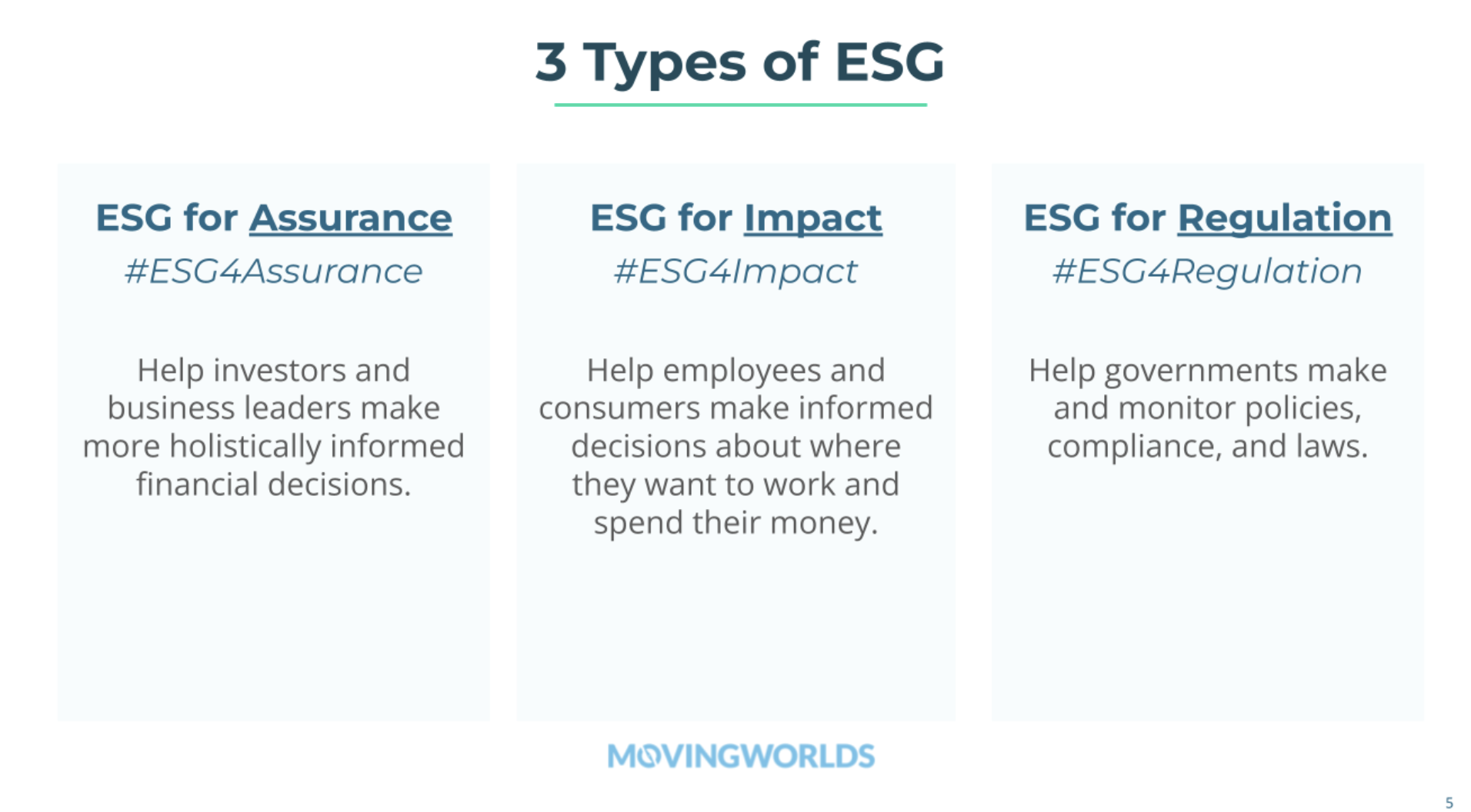

When debating ESG, stakeholders typically fall into one or more of the following categories in terms of what they want out of the movement: assurance, impact or regulation.

In this article, we’ll take a closer look at each, and suggest how they can be used together to facilitate the implementation of meaningful practices that positively impact society and the environment.

ESG for assurance

ESG for assurance is all about adjusting for financial risk. From this perspective, ESG is a means to make better financial decisions — rather than a way to drive sustainable business transformation. This is what investors, board members and chief executives care the most about: monitoring potential risks to the financial bottom line (for example, a lawsuit for non-inclusive hiring practices, or decreased future earnings as natural resources become less available).

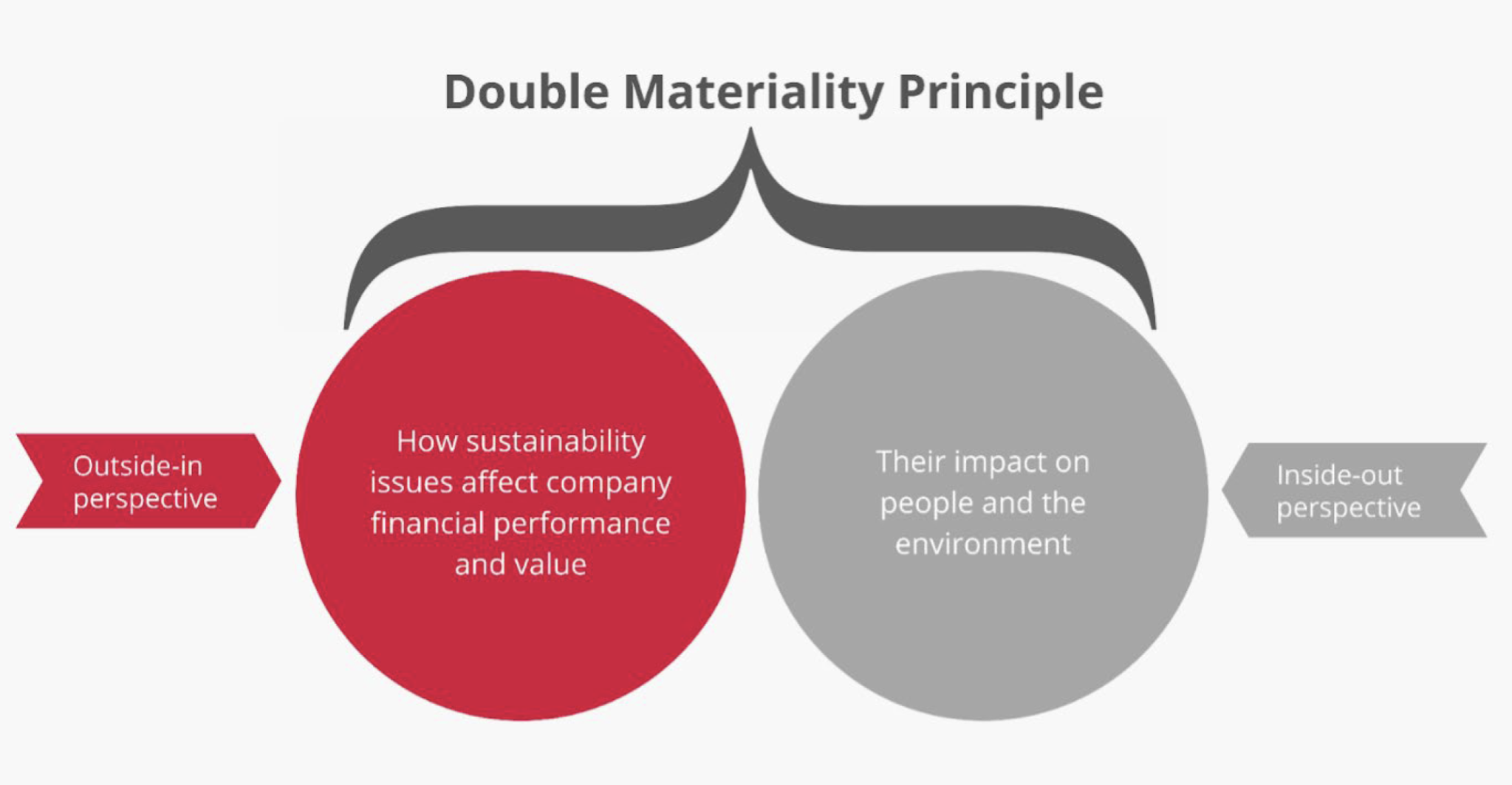

There are a number of frameworks out there to measure and report on this, all of which are voluntary, and some of which are more comprehensive than others. The conversation around ESG reporting continues to evolve, and increasingly, is moving toward a standard of Double Materiality:

A new report from Reuters has a nice explanation of this, and Proof of Impact recently published a piece on this same topic.

That being said, until we have a universally accepted standard for reporting, it will continue to be difficult to compare ESG performance across companies using different frameworks. International bodies are working to solve that problem, and at the U.N. COP26 climate talks in 2021, the International Sustainability Standards Board (ISSB) was established in order to merge the many ESG disclosure standards into one, and to encourage the uptake of these standards globally.

It’s important to note that this does not mean that ESG for assurance has anything to do with progress toward the U.N. Sustainable Development Goals (SDGs). Even if we arrive at a universal standard for reporting, companies can still report on factors like their environmental impact (carbon emissions, as an example) without any intention to reduce or address them.

While it’s true that ESG will never reach its full potential when viewed exclusively through a financial materiality lens, it is still important to work toward a universal standard for the sake of comparison and global adoption. However, as EY points out, the need to build consensus across the globe puts global standards at risk of being drawn down to the lowest common denominator. That’s why, on its own, ESG for assurance isn’t enough.

ESG for impact

ESG for impact is about leveraging ESG to drive more sustainable, equitable business models. As opposed to assurance, which is about mitigating financial risk, ESG for impact is about creating positive social and environmental value.

ESG for impact is typically driven by a company itself, rather than an external reporting or regulatory body. A company will typically be motivated to make a real impact on environmental, social and governance factors when it sees the possibility of realizing a positive returns on that investment, including:

- Building the brand and attracting new and more loyal customers

- Helping tap into new markets and customers

- Recruiting, engaging, and retaining the best employees

- Driving better governmental regulations and relationships

- Qualifying for preferential treatment with other business partners and suppliers

Microsoft, for example, was not forced by any external body to make investments in becoming both carbon neutral and water negative, however, it did so because it helps build goodwill with some of its biggest customers (including governments) and also helps it retain and engage its employees.

As mentioned above, realizing the potential of ESG for impact still requires a universal standard to serve as a common measuring stick. The difference is that when reporting from this perspective, an additional step is taken to then address and improve those factors (versus simply disclosing them).

Social impact professionals, consumers and employees tend to care the most about impact. In some cases, politicians do as well, given that many of the priorities of potential voters relate to society and the environment. However, a desire to do good from a handful of companies is not enough to change the economy and achieve the SDGs. This is why ESG for regulation is still needed.

ESG for regulation

ESG for regulation is something that is imposed by an outside governing body — like a national government or the U.S. Securities and Exchange Commission (SEC). Globally, governments have imposed different ESG and CSR (corporate social responsibility) laws. Most of these are for disclosure and assurance purposes, and to facilitate the adoption of universal standards that make comparison across sectors and geographies possible using the same measuring stick.

For example, earlier this year the SEC proposed a set of rules to standardize and enhance climate-related disclosures for investors. These rules don’t set specific targets that companies need to achieve for impact purposes, but rather, are meant to unify ESG for assurance frameworks for easier comparison. Still, some governments, like India and Singapore, take regulation a step further by actually building in criteria related to impact.

While not explicitly tied to ESG for impact, ESG for regulation is still an important part of scaling the movement. While investors will use those disclosures to make financial decisions, employees and consumers can use that same information to make decisions about whether or not to engage with certain companies based on their track records.

Combining the three to move the movement forward

The ESG space is rapidly evolving and expanding, and debates are an inherent part of that. But for those debates to lead to any type of meaningful outcome, all stakeholders need to be more active in owning their intentions for ESG initiatives and reporting — and also in labeling and communicating them.

Indeed, at the most basic level, companies need to report on environmental, social and governance factors for assurance and regulatory purposes. But those things aren’t necessarily mutually exclusive to ESG for impact -— in fact, assurance, impact and regulation are all needed for the movement to reach its full potential.

ESG can help facilitate better financial decisions and progress toward the SDGs. After all, as former CEO of Unilever Paul Polman puts it, investing in a more sustainable and regenerative economy is “the biggest business opportunity of our time”... and the future of our planet depends on it.

Image credit: Nick Staal/Unsplash

Graphics courtesy of Moving Worlds

Mark Horoszowski is CEO at MovingWorlds, a social enterprise helping corporations develop scalable social impact programs and world-positive leaders. Mark is an RSA Fellow and also lectures on corporate social responsibility at the University of Washington.