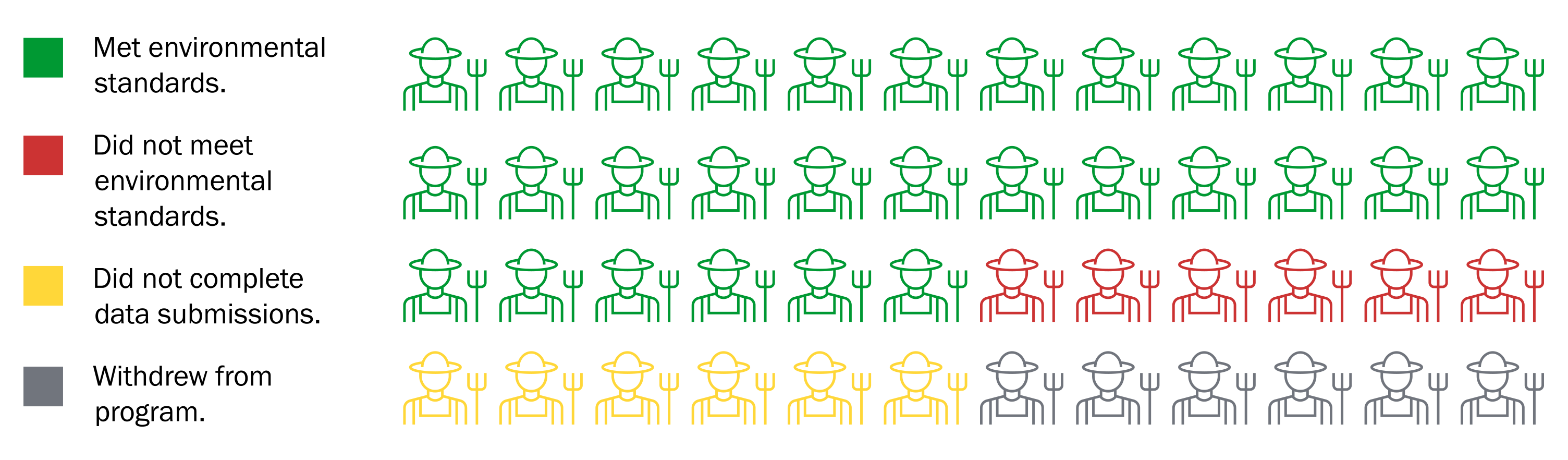

A new loan program focused on regenerative agriculture techniques is reporting impressive results from its pilot year. Regenerative Agricultural Financing rewards farmers who protect the topsoil and use fertilizers responsibly. Eighty-three percent of the farmers who completed it in 2022 did just that, earning back 0.5 percent of their interest rate.

The program is the product of a partnership between the Environmental Defense Fund and the Farmers Business Network. And its success — coupled with farmers' enthusiasm — points to a promising new path for both lenders and borrowers that could potentially be replicated in other industries.

Innovative lending to promote regenerative agriculture and more

“The big innovation here is that it's one of the first agricultural finance products to reward environmental stewardship,” Maggie Monast, senior director of climate-smart agriculture at the Environmental Defense Fund, told TriplePundit. “My goal is to encourage others in the agricultural finance sector to create similar or tailored financial solutions of their own that really support farmers as they adopt climate-smart agriculture.”

Farmers were eager to jump on board, and the program “was quickly oversubscribed,” according to the fund. In order to accommodate demand, the initial budget of $25 million was doubled for 2023. The Farmers Business Network is looking to increase the loan program’s lending power to $500 million over the next five years, Monast said.

During the pilot year, 48 farmers participated in the program, and data was collected for 42,000 acres. There are 87 farmers enrolled for 2023, and although data on the total acreage is not in yet, Monast said she expects it will be roughly double what it was in 2022. “We're thrilled with the farmer interest and success of the regenerative agriculture financing program,” she said. “But really, we'll be seeing more success when other agricultural banks and farm credit cooperatives are following suit and working with farmers in a similar way.”

Results-based standards for regenerative agriculture

In order to earn their interest rate rebate, participating farmers had to meet environmental standards for two primary metrics: nitrogen fertilizer use and soil health. By doing so, farmers could save money above and beyond their rebate. And by reducing their nitrogen fertilizer usage to a more efficient level, they could save on inputs, as well.

“Nitrogen is necessary to grow our crops, but when it's used in excess, it both pollutes water through nitrate loss and it contributes a really potent greenhouse gas — nitrous oxide — which is 300 times more potent than carbon dioxide,” Monast said. “Farmers were required to stay within an efficient amount of nitrogen fertilizer use, and also to be using one or more soil health practices.”

The main soil health practices used were planting cover crops — plants used to cover bare soil — and adopting no-till farming — planting in soil that has not been churned up, she said. Flexibility was also allowed for other methods. “Those practices really build soil health and can contribute nutrients back into the soil, which supports farmers in reducing nitrogen fertilizer use and can also support farmers in reducing herbicide use,” Monast said.

Additionally, practicing no-till farming protects the soil from water and wind erosion and retains sequestered carbon, Monast said. And cover crops do their own part in keeping the soil in place and preventing erosion. “They add organic matter to the soil,” she said. “Depending on what kind of cover crop you use, they can also add nutrients back into the soil. So, if you use a nitrogen-fixing cover crop, it adds nutrients back into the soil … that allows you to then dial back on the nitrogen fertilizer you're applying and the herbicides you're applying because you're replacing some of that with the function of the cover crop.”

Room for expansion

While the program was limited to soy, corn and wheat agriculture based on the nitrogen balance science the Environmental Defense Fund had available, Monast noted the possibility of scaling to other crops in the future. And she’s eager to see more lenders following the Farmers Business Network’s lead now that it’s clear farmers are open to these kinds of loan programs.

“At the end of last year, we put out the first-ever global survey of agricultural finance institutions on climate risks and opportunities,” she said. “And from that survey, we found that 87 percent of agricultural lenders see climate change as a material risk to their business. But only 24 percent have integrated climate change into their decision-making in a substantial way. So, that gap essentially is showing where lenders need to improve so that their business is aligned with the risks that they see in the marketplace.”

In that survey, 59 percent of lenders said they think new business opportunities will be associated with climate change, which the Regenerative Agricultural Financing program is an example of, Monast said. “Data shows that lenders are thinking about this and that this is the future. And this product is the first example to show the why.”

Of course, agriculture isn’t the only sector affected by the climate crisis. It’s hard to imagine an industry that won’t face any repercussions as our planet warms. The effects on investments will no doubt be far-reaching. Lending programs modeled after this one could have the potential to promote environmental stewardship beyond regenerative agriculture by rewarding reductions in emissions, increased use of post-consumer recycled materials, curtailed use of natural resources and many other innovative methods.

Image credits: Irewolede/Unsplash and EDF

Riya Anne Polcastro is an author, photographer and adventurer based out of Baja California Sur, México. She enjoys writing just about anything, from gritty fiction to business and environmental issues. She is especially interested in how sustainability can be harnessed to encourage economic and environmental equity between the Global South and North. One day she hopes to travel the world with nothing but a backpack and her trusty laptop.